[Key News]

Take-Two buys Zynga for US$12.7B enterprise value

INVESTMENT

- MI Insight:

- Take-Two Interactive made the biggest acquisition in the history of the video game industry

- The deal will also add an enhanced focus on new business models such NFT games since Zynga recently said it was focusing on nonfungible tokens (NFTs) and new business models that can come with it

- Through this acquisition, Take-Two will gain access to Zynga's major casual game titles such as "FarmVille", "Words With Friends" and "High Heels!"

- Take-Two will soon be able to leverage Zynga's expertise in making popular free mobile games to develop new games based on its own PC and console game IPs such as GTA, NBA 2K and Civilization

- Take-Twois buying mobile social game publisher Zynga for an enterprise value of US$12.7 billion

- The move will trigger a big consolidation in gaming, combining Take-Two’s success in hardcore video games with its Rockstar Games label and San Francisco-based Zynga’s strong position in mobile social games such as Words With Friends, Zynga Poker, and Empires & Puzzles

- The transaction is expected to establish Take-Two as a leader in mobile gaming, with mobile expected to comprise over 50% of its net bookings in the fiscal year 2023

Developer of "I am MT" recently acquired by Tencent

INVESTMENT

- Locojoy is the developer of “I am MT” and SLG game “Conquest and domination(政府与霸业)”

- Tencent now holds a share of 100%

- Through the acquisition, Tencent will focus on building IP “I am MT”

Apple to make third-party payments available in South Korea

FINANCIAL

- Third-party payment systems will be allowed on the App Store in order to comply with the new law

- Apple rejected the Fortnite publisher's request to have its Fortnite developer account reinstated in South Korea, following the changes in law

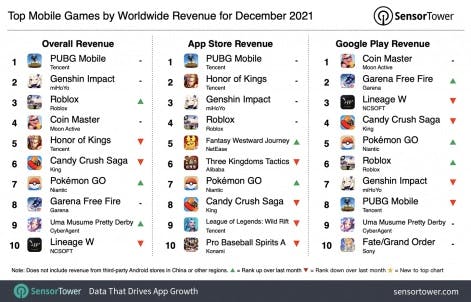

4. PUBG Mobile takes top spot in December 2021 at US$244 million

GAME PRODUCT

- PUBG Mobile from Tencent was the highest-grossing mobile game worldwide for December 2021 according to Sensor Tower

- In Dec 2021, PUBG Mobile generated US$244 million in consumer spending, an increase of 36.7% YoY

- This marks the fifth time the title has taken the top revenue spot in 2021

- China’s version of the title was where the majority of the revenue – around 63.3% – was generated; The US was the second-highest spender at 6.8%, followed by Turkey at 5.5%

[Important – Market Report]

App Annie: State of Mobile 2022 report

MOBILE GAME MARKET

- Please see the complete report from here: LINK

- Mobile Trends 2021

- Mobile-First Markets Spend 1/3 of Waking Hours on Mobile

- Across the top 10 markets analyzed, the weighted average surpassed 4 hours 48 minutes in 2021 —up 30% from 2019

- Globally 230 Billion Downloads, US$170 Billion in consumer spend 3.8 Trillion Hours

- Despite IDFA Fears, Dollars Flocked to Mobile Ads — Topping US$295B in 2021, up 23% YoY and Poised to Hit US$350B in 2022

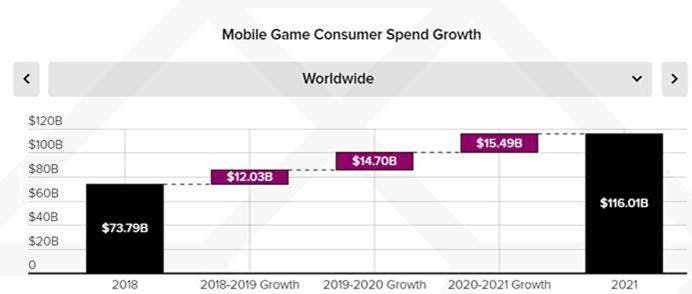

- Mobile Gaming 2021

- Additional US$16 Billion in gaming consumer spend was added in 2021, bringing total to US$116 Billion, an increase of 15%, fueled by the growth of hypercasual games

- Interest in the metaverse catapulted leading avatar apps forward with 160% YoY growth

- 4x March-Battle Strategy Games Emerged as the Most Monetizable Genre for Mobile Games

- Party, Simulation, Shooters & RPG Skew Towards Gen Z; Match 3 & Puzzle Preferred By Older Age Groups

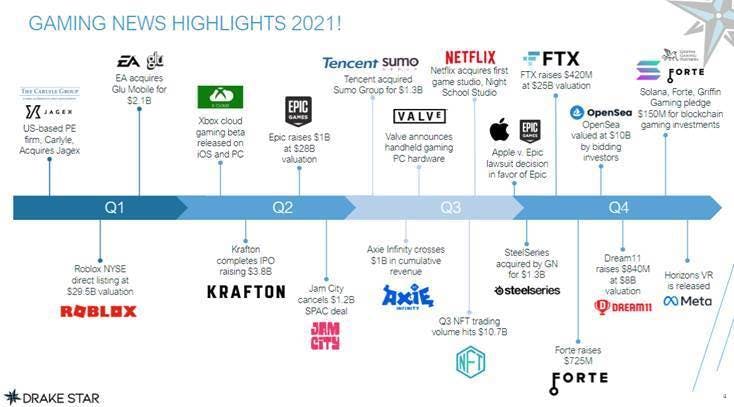

Drake Star Partners: Game deals topped US$85B across 1,159 transactions in 2021

GAME INVESTMENT

- Please see the complete report from here: LINK

- 2021 was a landmark year for gaming with almost 3x the deal value of 2020

- Exceptional US$38B in M&A activities across all segments driven by major strategics (Embracer, Tencent, EPIC, Take Two, Sony, Stillfront, Zynga, EA, ByteDance, Devolver, MTG) as well as PE firms

- VCs and strategics invested an unprecedented US$13B in private companies through 718 deals. Big rounds were raised by Epic, Dream11 and JamCity. Galaxy, Bitkraft, Makers, a16z, Play Ventures and Griffin were most active gaming VCs

- US$3.6B was raised by private blockchain / NFT gaming companies. Animoca, a16z, Coatue, Softbank were very active investors and large rounds were raised by Forte, Sorare, Dapper Labs

- 2021 was a banner year for IPOs, direct listings and SPACs: Roblox, Krafton, Unity, IronSource, AppLovin, Playtika, Playstudios, Nexters, Skil

Sensor Tower: Dec Top 30 Grossing Chinese mobile in oversea App store & Google Play

GAME RANKING

- Genshin Impact exceededUS$96 Million, ranking the first in the list

- Call of duty ranked 3rd and revenue exceeded US$1.3 billion since launched in 2019 in oversea market

- PUBG mobile ranked 2nd in the revenue list and 1st in the Top download Chinese mobile in oversea App Store & Google play

Newzoo’s Games Trends to Watch in 2022

GAME TREND 2022

- Play-to-Earn Will Become a More Viable Business Model

- NFT games face many challenges

- Valve has banned crypto- and NFT-based games on Steam

- One of highest spending market - South Korea has banned crypto-based games on Google Play and the iOS App Store

- Players have been vocally against NFTs in games

- Metaverse Anticipation will drive both Investment and VR Sales

- Apple and Google will open their closed App Store Ecosystems (to some extent)

- Game IP Value spikes as transmedia becomes more relevant

[Important – Metaverse & NFT Games]

Tencent to buy Xiaomi-backed gaming phone maker, the deal will fuel Tencent’s metaverse ambitions

METAVERSE

- Tencent is planning to buy Xiaomi-backed Black Shark, a maker of niche gaming phones and accessories, in a deal that will see the latter make virtual reality headsets

- While the size of the deal was not disclosed, the acquisition may help fuel Tencent’s metaverse ambitions

Netmarble F&C acquires blockchain game company 'Itam Games'

NFT GAMES

- Netmarble announced that its subsidiary Netmarble F&C will acquire Itam Games, a specialized game company based on blockchain through a public announcement

- With this acquisition as an opportunity, Netmarble F&C plans to introduce blockchain technology to the game under development to speed up its penetration into the global P2E (Play to Earn) and Non-Fungible Token (NFT) markets

- Established in 2018, ITAM Games is a company with middleware technology that applies P2E systems to mobile games in a short period of time and has experience and expertise in building NFT marketplaces

- The company is servicing blockchain games on the Binance Smart Chain, and is expected to play a role in the metanomics ecosystem that Netmarble is building in the future

Npixel builds its own blockchain game ecosystem with 'Gran Saga' IP

NFT GAMES

- 'Npixel', the developer of the mobile MMORPG 'Gran Saga', has started building its own blockchain ecosystem

- Npixel introduced a new blockchain-based project 'Granverse' brand page. 'Granverse' is a project that combines the IP of 'Gran Saga', the first title of Npixel, with blockchain technology

- In addition to 'Granverse', Npixel plans to diversify blockchain-based businesses. Currently, Npixel is preparing a decentralized autonomous organization (DAO)-based game ecosystem such as 'Project Pixel', a sandbox game that Gransa reinterprets IP with 2D dot graphics, and 'Non-fungible Token' (NFT) using art resources

- Granverse aims to build a decentralized virtual world called Web 3.0

- Npixel, a startup established in September 2017, attracted 100 billion won in Series B investment from Saehan Startup Investment in August of last year. In recognition of its corporate value of 1 trillion won, it was listed as a 'unicorn company' in the shortest period of time in the domestic game industry