[ Key News ]

1. The Pokemon Company Acquires Millennium Print Group

THE COMPANY IS A TCG CARD MANUFACTURER

- The Pokemon Company announces that it's acquiring Millennium Print Group, the company behind printing its cards

- This uptick in demand for Pokemon cards was partly fueled by the prominence shown by popular content creators and collectors

- The boost in demand for Pokemon cards was notably high during the pandemic with the company selling over 34 billion cards in 2020, which was 3.7 billion more than the previous year

- The acquisition of Millennium Print Group could indicate that the Pokemon company may also be looking to streamline and exercise better control over the Pokemon cards market

2. Moonlighter is Netflix Games' first non-exclusive title

NON F2P ACTION RPG MOBILE TITLES

- Netflix has entered a partnership with 11 bit studios to bring the action RPG Moonlighter to its mobile games roster

- Developed by Digital Sun, Moonlighter was originally launched on PC and consoles in 2018

- As Netflix has recently reported a fall in subscribers, the move to bring premium games such as Moonlighter into its games service can be seen as an increased effort to offer subscribers more for their money over other subscription services

- Netflix has been stepping up its activity in the games space with its recent acquisitions of Boss Fight Entertainment and Next Games, as well as a partnership to launch a new mobile version of the popular card game Exploding Kittens that will tie in with a new animated series

3. Next New Game Trend from China: Waifu Art Style + FPS / TPS +3D

NEXT GAME TREND IN CN

- There are many game companies in China are trying the new game genre & Game play: Waifu style game characters + 3D Shooting game Play, for an example, Kingsoft’s Project Snow has exceed pre-registration number of 1 million

- Waifu games are led by Genshin Impact while Shooting genres are pushed by game of peace in China; Two game elements has large user bases, the potential of combine two game elements is huge

- Waifu Art Style shooting games such as Nikki & The Dawn received great responses from the players

- NetEase SLG mobile game "The Lord of the Rings: Rise to War" landed in Japan, South Korea, Hong Kong, Macao and Taiwan at the same time. As of press time, this game ranks first on the iOS free list in South Korea& HK, second on the Japan & Taiwan free list

- The game was launched simultaneously in Europe, America, Oceania and Southeast Asia, and the monthly revenue was stable at aroundUS$7.8M, ranking among the Top 20 global SLG revenue

- Japan has become the main market for SLG genre; 56% of total revenue of 37 games’s Puzzle and Survival’s comes from Japan, monthly revenue in Japan was as high as US$30M

- Three Kindoms Strategy even now is among Top 20 games in japan by revenue

5. Coda Payments raises US$690M for cross-border payments and alternative app stores

US$690m FUNDINGS TO ENABLE CROSS-BORDER PAYMENTS

- Coda Payments has raised US$690 million in funding to enable cross-border payments for games and other digital products, as well as alternative app stores

- Smash Capital, Insight Partners, and GIC invested funds to acquire a minority stake in the Singapore-based company as it expands to more territories

- While the funding amount is impressive, no money will go to the company as existing longtime shareholders are selling their stakes to the new investors

- Apis Partners and all of the company’s other existing shareholders retain equity positions in Coda moving forward

- Codashop bills itself as a trusted source of in-game currencies and other premium content for millions of consumers in more than 50 territories worldwide

6. Webzen union strikes for the first time in the game industry on the 2nd of next month

SOUTH KOREAN GAME INDUSTRY WENT FOR STRIKE FOR THE FIRST TIME

- Labor and management failed to reach an agreement even after going through the first wage negotiations in January and even mediation by the local Labor Relations Commission

- Earlier, the union demanded a 'increase of 10 million won of yearly salary for each employee' and the management suggested an 'average increase of 10%' (about 4.8 to 5 million won). After going through the adjustment of the Labor Relations Commission, the union offered a compromise of 2 million won in a lump sum and an 'average increase of 16%', but the management stuck to the proposal of an additional 2 million won for above evaluation B, and the negotiations broke down

- The union held a vote in favor of the strike from the 6th to the 8th.It is reported that 92.8% of union members participated in the voting, and more than one-third were in favor of the strike.

- At the press conference on the same day, Kakao branch labor union chairman Seo Seung-wook supported the Webzen strike through solidarity remarks, and Nexon branch labor union chairman Bae Su-chan also contributed

7. VNG Launch Ys6 Alpha Test for Indonesia and Other SEA Market

YS6 COMING TO SEA

- VNG recently launched Alpha Test for their new mobile game title 'Ys6: Ark of Napihstim' which be held on 21st to 26th April 2022, for both AOS and IOS devices.

- Ys6 Mobile is an 3D Action JRPG from popular Ys Series which have been release in game console for 30 years.

- Players will enjoy to explore the world of Ys6 continent and storyline with plenty of PvE and PvP features in the game.

- There will be limited 10.000 users who can enjoy Alpha Test launch in 5 region SEA countries (Indonesia, Thailand, Philippines, Vietnam and Singapore + Malaysia), with 2.000 players limit for each region

[ Market Report ]

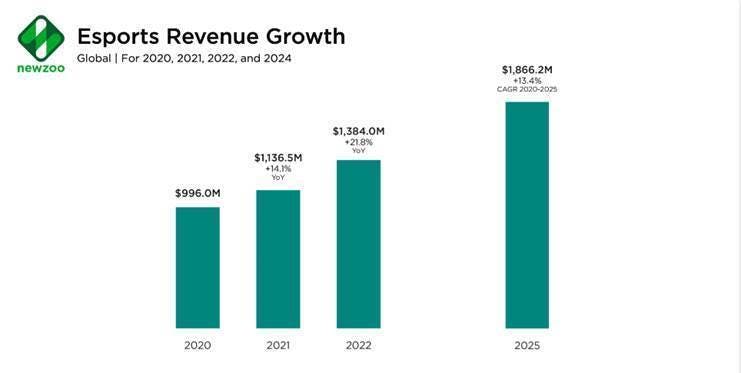

8. Newzoo: Esports will generate US$1.38B in revenue by the end of the year

THE GLOBAL ESPORTS AUDIENCE WILL PASS HALF A BILLION IN 2022

- Audience:

- The global esports audience will grow +8.7% YoY to reach 532 million

- Esports enthusiasts—those who watch esports content more than once a month—will account for just over 261 million

- Occasional viewers—those who watch esports content but less than once a month—will account for the remaining 271 million

- The Drives behind

- Like esports YoY growth this year, we also attribute the market’s longer-term growth to emerging markets like across Southeast Asia, Latin America, and the Middle East and Africa. Moonton, Tencent, Garena, and other publishers are heavily investing in the competitive side of mobile games in these markets, and they are finding great success

- As high-end hardware becomes more available and the internet infrastructure evolves, esports will be more accessible than ever, also contributing to growth

- Rising Revenues

- Esports will generate nearly US$1.38 billion in revenues globally by the end of 2022. China accounts for nearly a third of worldwide esports revenues

- Luckily, many esports organizations are diversifying their revenue streams away from sponsorship: Direct-to-fan monetization, digital merch and NFTs, loyalty schemes, traditional investment, and educational programs are just a few ways esports organizations are diversifying their revenue streams

- Regional Asia-Pacific esports revenues will grow by +17% year on year to reach $590.2 million in 2022, accounting for nearly 42% of global revenues

- Digital and streaming are the two fastest-growing revenue streams for esports, with 2020-2025 CAGRs of +27.2% and +24.8%, respectively

- Growing awareness around digital assets and NFTs will likely boost investment and fan interest in acquiring in-game items of esports IP

- Twitch was the biggest platform for game streaming in the West, with YouTube Gaming being the second-largest. Last year they clocked nearly 20 billion gaming hours and 4.7 billion gaming hours watched, respectively

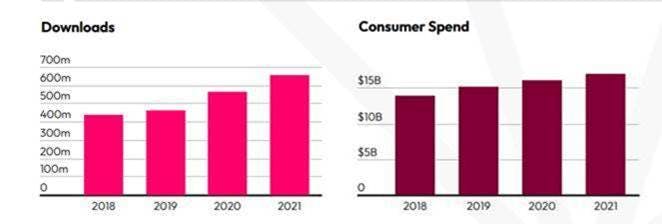

9. The state of mobile anime gaming in 2022

ANIME GAMES NOT YET TO REACH THE MAINSTREAM BUT ARE PICKING UP GLOBALLY

- Anime Games Market Sizing:

- Global demand for anime-themed games remained strong after pandemic-induced boost: downloads up 50% from 2018

- IN 2021, Anime downloads market size reached at 658Million and revenue has reached at US$17B

- Japan is still the Top 1 country of Anime games market in 2021

- Japan Remains Largest Market for Anime Games at 55% in 2021, but Market Share has decreased by 9 percentage points from 2018

- South Korea, UK, US have seen revenue growth of Avg. 72% from 2018

- Genre Trends & Top Performers

- Downloads

- Team Battle (RPG) Led Share Among Anime Game Downloads

- However top games varied significantly by market. MMORPG games with anime art style in China, South Korea and the US saw Strong Growth YoY, up to 854%

- Top games tend to span RPG and Simulation genres with the exception of one breakout MOBA (Action) game

- Top 5 games by downloads: Pokemon Go, Genshin Impact, Sakura School Simulator, Pokemon Unite, Gacha Life

- Revenue

- Idol Training Simulation Games are Gaining Ground In App Store Monetization — Led by Uma Musume Pretty Derby in Japan

- Open World RPG was another standout globally with revenue up 233% YoY globally — fueled by Genshin Impact

- Top 5 games by revenue: Genshin impact, Pokemon go, Uma Musume Pretty Derby, Fate/Grand Order, Monster Strike

- Anime games are niche, but Highly Engaged Audience with Huge Spending Appetite: Anime Game audiences accounted for $1 of Every $5 spent through the app stores on mobile games in 2021, yet global usage penetration was <3% for most used game

- Anime games Audiences

- Anime Game Audiences are Mostly Gen-Z Leaning, but Gender Preferences Vary Significantly by Subgenre & Market

- Users in the Gen Z age group are 3.1x times more likely to play MOBA (Action) Anime games, while Millenials are almost as likely to play Location RPG (RPG) Anime games compared to the average population.

- Anime Game Audiences Tend to OverIndex on Gaming-Focused Social Media Platforms such as Discord, Even More So than the General Gaming Population

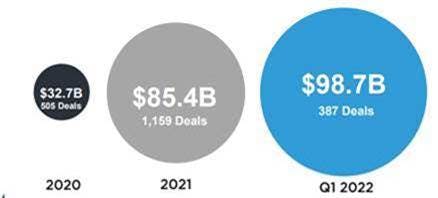

10. Drake Star: Q1 game deals hit US$98.7B in value, more than all of 2022

ALL OF 2022 CAN EXCEED US$150B

- 2022 started the year with a bang, already surpassing the full year 2021 deal value with a massive US$98.7B in total value of announced and / or closed deals for Q1’22

- Massive industry consolidation with US$92.6M in M&A activity across PC / console, mobile and esports, including acquisition of Activision by Microsoft, Zynga by Take-Two, Bungie by Sony and ESL by Savvy Games / PIF

- VCs and strategics invested US$3.4B in private companies through 287 deals, a record-breaking quarter for number of deals completed. Large rounds were raised by Dream Games, thatgamecompany, Tripledot, and Zupee while the most active VCs included Bitkraft, Sequoia, Makers Fund and Griffin Gaming

- US$1.2B was raised by private blockchain / NFT gaming companies with the largest rounds raised by Animoca Brands, Immutable, and New Sin City, while the most active investors were Animoca Brands, Alameda Research / FTX, and Shima Capital

- Record number of new and follow-on funds focused on gaming and crypto space, including FTX’s $2B fund, Griffin Gaming Partners’ $750M fund, Makers’ $500M fund, Hiro Capital’s $340M fund, Gumi Crypto $110M and many more

[ Metaverse & NFT Games ]

11. Playable Worlds raises over US$25M for cloud-based sandbox MMO

KAKAO GAMES LED THE INVETSMENT, LILITH ALSO JOINED THE ROUND

- Playable Worlds announced today that it has secured over UD$25 million in a funding round led by Korean video game publisher Kakao Games Corp., a subsidiary of mobile messaging firm Kakao

- This strategic investment will be used to drive Playable Worlds’ talent recruitment and fund its cloud-native sandbox massively multiplayer online (MMO) game currently in development

- New investors Lilith Games and Gaingels also joined the round, which follows a US$10 million funding in 2020

- Game veterans Raph Koster and Eric Goldberg started the company in 2018 in San Marcos, California, near San Diego