[ Key News ]

1. Microsoft’s gaming revenue declines 7% in June 30 quarter

- Microsoft revealed in its earnings report today that its gaming revenue declined 7% (5% in constant currency) in the fourth fiscal quarter ended June 30, compared to a year ago

- Xbox content and service revenue declined 6% (4% in constant currency), driven by lower engagement hours and monetization in third-party and first-party content. It was partially offset by growth in Xbox Game Pass subscriptions

- Microsoft chief financial officer Amy Hood said in an analyst call that the results do not include anything from Activision Blizzard, which Microsoft is in the process of buying for US$68.5 billion

2. NetEase finally releases Diablo Immortal in China on iOS and Android on 25th July

- NetEase did not make any social media announcement about the new launch date of the game, which is still banned from posting on Weibo

- The latest instalment of the Diablo franchise was originally set for release in China last month, along with an international debut in the same month

- Diablo Immortal, the free-to-play Diablo game for mobile and PC, was delayed in China last month because of a social media post that could be interpreted as criticism of Chinese President Xi Jinping

- Rumor saying that Blizzard and its Chinese partner Tencent have smoothed over the issues

- Co-developed by NetEase and Activision Blizzard, the game is doing well both in overall revenue and in terms of downloads/installs. Diablo Immortal's official social media shared a message saying the game has been downloaded and installed 20 million times so far and counting

- Diablo Immortal generated over US$50 million, revenue generated are quite impressive, especially considering the game wasn't released in China up until yesterday

- Diablo Immortal 's low-key launch in China did not seem to have dampened the spirit of fans, who lined up online before midnight to be one of the first to play the game in the country. Some popular servers saw queues of more than 5,000 people, causing traffic jams

- The game ranked 5th on the iOS Top Grossing list in China market and topped the free list too

- Diablo Immortal's release in China could help calm the nerves of industry players in the world’s largest video gaming market, worried about a tightened regulatory environment and slowing economy

3. Indonesia Requires Game Companies To Register With Local Government

- Indonesia has introduced regulations that see game companies looking to do business in the country registering with the government to do business in the country

- In a report published by Niko Partners, they mentioned the addition of regulation no. 5 of 2020 on Penyelenggara Sistem Elektronik Swasta (PSE) or Private Electronic System Providers

- It covers any software offering services or doing business in Indonesia, and covers not just mobile games but also PC games and social media apps as well

- This regulation would see developers and other companies registering via the PSE website, and repeated failure to do so will ultimately be met with access termination in the country

- Currently over 280 foreign entities have registered with the list, with more recent games like Dislyte and older titles like Konosuba: Fantastic Days both being on the register

- For those companies that fail to meet the deadline, officials said sanctions will be gradually imposed in three stages: The first is the sanctioned form of a written warning and requires it to complete the registration within 5 working days. The second step is to impose fines, and the third is to impose administrative penalties that prevent access

4. WeChat platform strengthens the supervision of Chinese mahjong games and fishing hunter casino like games, requiring companies to provide law firm compliance assessment reports

- WeChat released a reminder for gambling-related self-examinations in mahjong and fishing hunter games. Not only are they required to provide compliance reports, but they also need to be stamped by law firms. At the same time, after every major update every quarter, developers need to supplement their own explanations and submit update materials to the WeChat mini game platform

- Mahjong & fishing hunting games accounted for 30% of game licensing in China market in 2018, after china tech crack down, the game licensing of mahjong & fish hunting games decreased to 2% only, however, market size of this genre continue expanding

- In June 2019, the monthly market size of domestic mahjong mobile games was less than US$15 million; As of June 2022, the total monthly revenue of mahjong mobile games has reached US$83 million, and it reached a peak of US$89 million in March this year. Compared with 3 years ago, mahjong mobile games have increased by nearly 600%

- Although the number of new mahjong games is small, the core gameplay itself has not changed much, and the replay ability is strong; The game type has long-term retention and does not depend on the frequent introduction of new products

5. 37 games again layoff hundreds of people

- According to the 2021 financial report data, the total number of employees of 37 games is 3,996

- Current employee churn rate of 37 games is 3.25%; Tencent's employee churn rate last year was 12.4%

- This time layoff could be 200 ~ 300 people

- June this year, online game UA costs have dropped to US$96 million, a year-on-year decrease of more than 60%

6. Life Makeover Global pre-reg exceeded 10 million, Topped iOS free list in many markets

- On the 28th Jul, Zulong’s Life Makeover has launched in Taiwan, Hongkong and Macau market and topped iOS free list in these markets

- The game’s graphic is high quality, developed with UE4, and changing costume has free style game play mode

- The game has high detailed and high freedom in character customization

- The game also has another Simulation game play such as buying and building your own home

- The game will launch in Japan, SEA, china and western countries soon

7. Supercell's Boom Beach: Frontlines pre-registration reaches one million players in 48 hours

- After a successful first soft launch period held exclusively in Canada, pre-registrations for the latest title in Supercell’s Boom Beach franchise – Frontlines – has already hit the one million players mark after opening just two days ago, on July 25th 2022

- The title is being helmed by UK developer Space Ape Games, best known for Beatstar, following Supercell's US$37 million investment, which increased its stake in the UK developer to 75%

8. India blocks battle-royale game BGMI two years after PUBG ban

- Google has pulled the popular battle royale game Battlegrounds Mobile India, more popularly known as BGMI, from Play Store in India after a New Delhi order, a year after developer Krafton launched the app following a ban on similar title PUBG in the South Asian market. The BGMI game has also been delisted from Apple’s App Store in the country

- The development follows a growing tension between India and China, two nuclear-armed neighboring nations that have been especially at odds since deadly skirmishes along the Himalayan border in 2020

- India has since reacted to the move by banning over 300 China-linked apps including PUBG and TikTok, both of which counted India as their largest overseas market by users

- Krafton said it had cut ties with its publishing partner Tencent, who is also a major investor in the firm, and pledged to invest $100 million in India’s gaming ecosystem

- The South Korean-headquartered firm said earlier this week that over 100 million users had signed up for the game in India in the past one year since launch

- Krafton was open to investing an additional $100 million or more into the Indian gaming ecosystem this year

9. “Almost every” future Riot Games title will be competitive, says esports head

- At the launch of Riot’s Project Stryker broadcast centre in Dublin, Needham spoke to NME about the company’s plans to incorporate esports into future Riot titles – including Project L, an upcoming fighting game

- Project Stryker will be used to support the rest of Riot’s entertainment division, which include the company’s 2021 Netflix series Arcane and a long list of musical projects

10. Dragon Hunters: Heroes Legend from 4399 was removed from the Vietnam App store for 4 weeks due to game source code lead to 3rd party payment

- Dragon Hunters: Heroes Legend from 4399 was removed from VN App store since Apple found game source code can lead to a local payment

- 4399 also lack of cooperation with apple submission team cause the problem became widen

- The game fixed issues and now back to the store

11. Alibaba seeks dual primary listing in Hong Kong and Jack Ma may let go of Ant Group control

- Chinese ecommerce giant Alibaba Group announced that it is applying for a primary listing on the Hong Kong Stock Exchange while keeping its US listing. The process is expected to conclude by the end of this year

- Alibaba currently has a secondary listing in Hong Kong

- After the announcement, the company’s stock rose by over 5% this morning while the Hong Kong benchmark jumped 1.2%

- Last year, the firm was slapped with a record US$2.8 billion fine after an anti-monopoly probe by Chinese regulators

- Chinese business tycoon Jack Ma may distance himself from Ant Group and let go of his control of the firm

- It’s worth noting that Ma does not have an official position in Ant, nor is he a board member. However, he controls 50.52% of the company’s shares through an entity called Hangzhou Yunbo Investment Consultancy

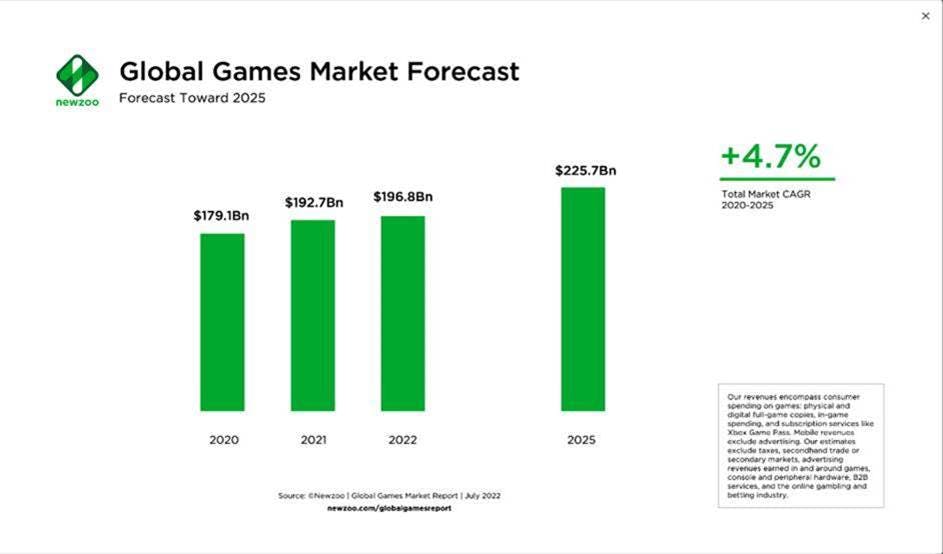

12. Newzoo: Global Game Market Report July 2022 - Games likely won’t hit US$200B in 2022, but the future looks bright

- Global Market Players & Payers:

- Globally, the number of players will grow from 2.9 billion in 2020 to 3.5 billion by 2025, a five-year CAGR of +4.2%

- Expect the number of paying players (payers) to grow from 1.2 billion payers in 2020 to 1.5 billion by 2025, a five-year CAGR of +4.3%

- Global Market Market Sizing:

- In 2022, the global games market as a whole will generate US$196.8 billion, up slightly year on year by +2.1%

- The primary driver of this growth across the world is mobile, which will generate revenues of US$103.5 billion this year (53% of the market), representing growth of +5.1%

- PC accounts for 21% of the market and will grow +1.6% year on year to US$40.4 billion. Meanwhile, console will decline by -2.2% year on year to US$52.9 billion—or 27% of the global market

- MENA Region – mobile first market

- Regions populated with mobile-first growth markets will see solid growth this year, with the Middle East and Africa growing +10.8% to $7.1 billion and Latin America growing +6.9% to US$8.7 billion in 2022

- Console’s downturn hardly impacted these mobile-first markets

- Global game trends

- Gaming the Ecosystem: Ecosystems are overlapping and expanding thanks to live services and subscriptions

- Mobile Privacy: The Sunsetting of Real-Time User Tracking Marks the Dawn of a Privacy-First MobileEconomy

- In-Game Advertising in AAA Console and PC Games Is Emerging as a New Revenue Stream

- User-Generated Content Inside Games and Out: A Strategy for Boosting User Engagement, Retention, and Content

- Globalization in the Games Market Has Continued With a New Trajectory: Just five years ago, it seemed the global games market was globalizing with China at the centre; however, regulatory changes in the Chinese market gated it off to many companies, especially non-Chinese companies (and particularly those from the West). The policies also make publishing games in China risky and difficult for local companies. Publishers in China were already diversifying their portfolios to cater to overseas markets like the U.S., Japan, and Southeast Asia. The regulatory changes only accelerated this

13. Facebook’s first Metaverse white paper 9 highlights to target the US$80 trillion market

- Recently, Meta (formerly Facebook) commissioned an international economic consulting firm, Analysis Group, to compile a Metaverse White Paper, which predicts the impact of Metaverse technology on the global economy based on the development of mobile devices

- The report predict that the metaverse market will be US$800 billion to US$2 trillion in the next few years. And when the metaverse is widely adopted, the metaverse market will be between US$3 trillion and US$30 trillion, and the most optimistic estimate can exceed US$80 trillion

- What is metaverse

- Metaverse is an extended network of Crypto space. Users can have VR (Virtual Reality), AR (Augmented Reality), MR (Mixed Reality) and other 3D immersive experiences in the Metaverse, and players can interact in real time

- The Metaverse is a large-scale, interactive, and real-time rendered 3D virtual network world

- Users can create their own avatar accounts in the Metaverse

- here are more ways to communicate. In the Metaverse, users can communicate with eyes, gestures, gestures, etc., not limited to typing or voice

- Metaverse can support almost all activity scenarios, such as socializing, working, learning, entertainment, shopping, creation

- The Metaverse is an open market where enterprises and individuals can freely experience

- Users have Crypto personalities and Crypto assets in the metaverse.

- The metaverse is not an object or a space, but a way in which different technological components are interconnected

- Metaverse will break the dependence of the Internet on devices and geographical locations, and create an online experience for people to participate in without being physically present through a naturally seamless and immersive experience.